Bookings generating revenue are good, but you also have to ensure that they are profitable - and it should not come as a positive surprise when the books for a voyage are being closed; you have to know it in advance before releasing a quotation or accepting a booking – and it is therefore important to know the economical yield of a business transaction before it is confirmed. This will not by itself eliminate bookings with negative contribution, but will enable you to know beforehand if the quotation or booking is expected to yield a negative or positive contribution; and by how much.

It is a commercial business decision whether or not to accept a booking with negative contribution, knowing that the negative contribution equals a direct loss of money whereas bookings with positive contributions may not necessarily result in net profit; there are only contributions toward the fixed costs - the costs accruing irrespective of whether the individual container or booking is accepted or not.

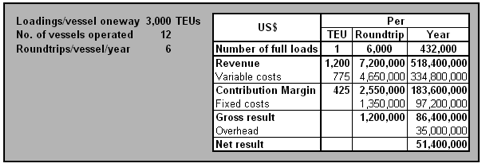

Therefore it is very important to clearly distinguish between variable costs which will directly (or indirectly) occur if the individual container or booking is accepted, and more fixed costs accruing irrespective of the individual container – illustration:

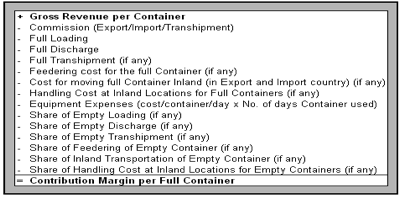

The main task to attack initially is thus to identify which cost elements to be considered variable – and how to treat them.

A number of cost types are quite straight forward - like cost for full load/discharge and haulage, whereas cost types pertaining to handling of empty containers - like empty load/discharge and empty positioning (land and water) can be included and dealt with differently:

|

|

These three require distribution keys to assign cost according to imbalance of full flow of containers (surplus/deficit) and each full container contributing to the imbalance is to get an equal share of the cost, i.e. a full container moved to a surplus area to “pay” its share of the empty evacuation cost. |

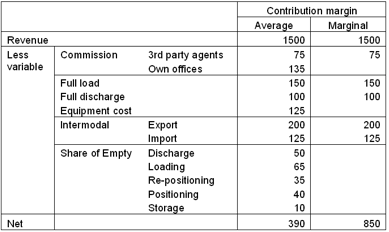

The above is for contribution calculations on the principle of applying all costs based on “average”, i.e. all get to pay the same share; but in certain instances it would also be useful to be able to apply costs based on “marginal” considerations.

The marginal contribution calculation can be used for short-term acceptance, e.g.

|

The purpose of working with marginal calculations is to be able to exclude certain costs for a short period of time from the contribution calculation, e.g. when a high number of empty containers have stock-piled - as if the marginal container is not booked (and thereby assisting to reduce the container inventory in this particular port), the only alternative is to re-position the container empty and therefore cost for empty handling can temporarily be disregarded.

| It could also be decided to exclude cost for operating the containers (equipment cost) as short term it is not possible to reduce the total equipment fleet. | |

| It is important to bear in mind that these costs will occur anyway, wherefore the marginal contribution calculation is to be used only for short time acceptances, but not for comparison to actual performance or actual cost; here the normal average contribution calculation is to be used. |  |

In summary, positive contribution margin does not equal profit yielded by the individual full container, but only its contribution towards the operating fixed costs and overhead - but a container yielding negative contribution results in a direct loss of money!

A change - up or down - of contribution margin for a full container, has an equal impact on the bottom line, so has an additional marginal booking yielding positive contribution.

Knowing the contribution for each container gives you a complete overview of total contribution for the entire voyage, as well as the ability to see the containers yielding low or even negative contribution.

In a weak market with limited cargo offerings not sufficient to fill the vessels, principally each container yielding a positive contribution should be accepting as it contributes to paying the fixed costs, whereas inn a strong market with space pressure, it is very important to establish a minimum level of CM required, e.g. for:

|

Apart from having worked directly with software pertaining to this area, I have also made business requirements definition, studies and recommendation on how to optimize contribution margin calculations and been advisor with main emphasis on topics related to contribution margin calculation and yield and performance management in general.

Finally, I was project manager and business responsible for scope, requirements, design and global implementation of Maersk Line’s profitability and contribution margin (and routing generation/selection) solution. Please contact me for a talk about how I can help you.